Former State Representative Troy Merner was arrested for allegedly felony wrongful voting and tampering with public records while serving in the NH House of Representatives.

NH Executive Council Places Women's Health at Risk

Charitable Gaming Commission Examines NH's Gaming Industry

It's Tme for NH to Meet its Educational Funding Obligations

Greenland Veteran's Day 2023 remarks by Dennis Malloy

Throughout this Nations’ history, America’s soldiers, sailors, aviators, Marines, and coastguardsmen have bravely answered the call to defend our freedom, to aid our friends and allies, and to turn back aggressors. We can never fully repay our debt of gratitude to the more than 1.1 million American service members who died in battle or the 1.4 million who were wounded, we can however, recognize and thank the twenty-five million veterans still living today.

While this country recognized Armistice Day for many years it was President Eisenhower who declared November 11 in 1954 as Veterans Day to solemnly remember the sacrifices of all those who fought so valiantly to preserve our heritage of freedom, and devote ourselves to the task of promoting an enduring peace so that their efforts shall not have been in vain.

After their service, men and women came home to raise families, work in the fields, learn a trade, run small and large businesses, serve as teachers and perhaps most importantly serve as mentors and leaders for the next generation. We are the proof and result of their service and dedication to this country.

Our nation honors her sons and daughters who answered the call to defend a country that celebrates personal achievement and provides for those cannot provide for themselves.

Our service men and women show us that heroism is remarkably sober and very undramatic. It is not the urge to surpass all others at whatever the cost, but the urge to serve others at whatever the cost.

America is free thanks to generations of people who gave the best way they knew how, but freedom is not the right to do as we please, it is the opportunity to do what is right. And what is right today, right now and for the future is to take a moment to say thanks to those for their very personal contribution to America.

State Representative Dennis Malloy with Greenland veteran Vaughn Morgan delivering remarks at the Greenland Veterans Hall on November 11, 2023.

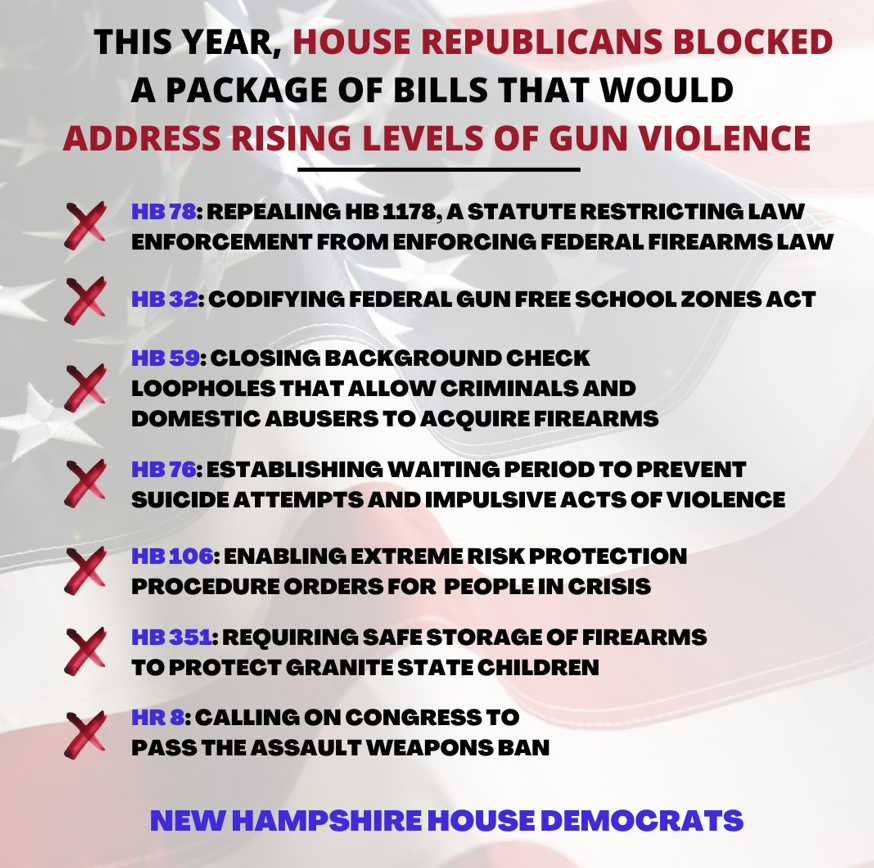

Gun Violence Initiatives Blocked in 2023

House Democrats put forth 7 initiatives to address gun violence this year. Unfortunately all of them were blocked on the House floor. Here’s the list.

Bi-Partisanship Resulted in Some Progress

In this forum, I’ve written extensively about the concerns we have in New Hampshire regarding affordable housing, support for young families and health care. During this session, we’ve made some progress by working together with the Republican majority. In fact, business leaders have consistently told the legislature that health care and housing are higher priorities than cutting the business taxes.

Policymakers added $25 million to the Affordable Housing Fund, which provides grants and low-interest loans for building or acquiring housing affordable to Granite Staters with low or moderate incomes.

The legislature contributed $10 million to the InvestNH Fund, which finances grants to developers and municipalities to support housing construction.

The Housing Champions Designation and Grant Program and provides $5.25 million in funding to incentivize municipalities to make certain land use and zoning changes, water and sewer upgrades, and policies to support walkability and transportation infrastructure. There is also a $10 million appropriation for housing shelter programs.

The state budget expanded access to childcare, particularly through enhanced eligibility for childcare scholarships. This expanded eligibility means that a family of two adults with one child and an income of up to $86,000 could receive some form of assistance.

Childcare providers will also receive higher reimbursements for enrolling scholarship students, adding more funding for staff. The state budget also makes a $15 million investment in childcare worker recruitment and retention.

The state budget includes $134.2 million in state funds for boosting reimbursement rates for Medicaid, which will be federally matched. Enhanced rates will help medical providers fund higher compensation for workers aiding recruitment. It also extends expanded Medicaid coverage for adults with low incomes which is important for workforce support.

We’ll see how the second year of this session develops. However, with a NH House that is nearly evenly divided, I’m encouraged that we will find new and innovative ways to cooperate that benefits working families and business in New Hampshire.

Source: NH Fiscal Policy Institute

The NH Legislature Ignores Your Calls for Lower Property Taxes

The lowering of the NH Business Profits and Business Enterprise taxes have had no material effect on NH’s economy. Businesses would prefer investment in education, health care and affordable housing instead.

Greenland, Rye State Representative Dennis Malloy serves on the Ways and Means Committee that crafts NH’s taxes and revenue policies.

New Hampshire has reduced taxes on corporate profits and eliminated the interest and dividends tax. Twice the legislature has shifted the cost of public employee pension obligations from the State to municipalities. The Motor Fuels Tax (MFT) revenue has not kept up with state road maintenance and the tobacco tax is showing signs of eroding.

By lowering some taxes, eliminating others, abandoning support for public employee pensions, and ignoring business friendly infrastructure needs both business and private property owners will be forced to make up for projected revenue losses with increased property taxes.

A recently released report from the non-partisan, non-profit New Hampshire Fiscal Policy Institute (NHFPI) reports that revenue generated from all New Hampshire sources amounts to more than $2.9 billion annually with more detail about NH’s tax revenue and the pressure it puts on our property taxpayers otherwise known as COST SHIFTING.

New Hampshire’s largest source of tax revenue is the property tax, the second largest source is the business profits tax (BPT), at 52 and 17 percent, respectively. Most businesses do not pay a BPT and after a series of reductions, the new 7.5 percent rate matches the corporate taxes levied by other New England states. Some believe that by lowering this rate from 8.5 percent just a few years ago current businesses will expand, and new ones to form in New Hampshire.

However, the Business and Industry Association (BIA) has repeatedly said that a lower corporate profits tax is not their biggest concern. Instead, New Hampshire should prioritize attracting and retaining workers for existing businesses, and invest in public education, health care and affordable housing. Lowering property taxes, improving transportation infrastructure, and expanding broadband access are just as important. New Hampshire’s corporations are asking us to create a friendlier business climate by investing in our people, our roads and our telecommunications resources. Gradually lowering the BPT has had little to no effect in helping business with their more important needs.

In another tax cutting move, the Interest and Dividends (I&D) tax has been eliminated. Gone is $158 million or 8 percent of NH’s General Fund revenue in tax year 2022. The I&D It is levied on individuals with over $2,400 and couples with $4,800 in annual income from savings and investments and disproportionally benefits wealthy households.

Historically, New Hampshire has supported the retirement system for certain public employees by funding over one-third of this obligation. Following the Great Recession of 2007-2009 the contribution was reduced and eliminated entirely in 2012 forcing local governments to pick up the tab since 2013 except for a smaller one-time aid last year. This year we proposed a 7.5 percent contribution, but it failed to be included in the budget. Since 2010 local property taxpayers have been making up for this loss.

Our MFT is flat at 10 percent of our budget and has not kept up with the soaring costs of road maintenance. Monies from the General Fund have been used to supplement the building, repairing and plowing of our state roads during the past four budget cycles. Currently, drivers of electric or hybrid vehicles either pay little or no MFT. The MFT also helps fund block grants to towns and cities for upkeep of the local transportation infrastructure.

The $232 million dollars collected by the state in tobacco tax is teetering due to shifting demographics and increasing health awareness. This is just over 7 percent of NH’s tax revenue.

There are many in New Hampshire who support the tax cuts, leaving the MFT alone, and letting municipalities be the sole source of support for local public employee pensions.

There has not really been a tax reduction, just COST SHIFTING. These moves will eventually show up on our property tax bills and it will be up to personal and business property taxpayers, to cover the costs.

The reliance on property taxes to pay our bills will only grow. Both businesses and our citizens have clearly stated that enough is enough. Investing in our people, resources and infrastructure is the way to grow the economy, retain our most talented citizens and give us some relief on our property taxes.

For a complete report by the NHFPI go to State Business Tax Rate Reductions Led to Between $496 Million and $729 Million Less for Public Services - New Hampshire Fiscal Policy Institute (nhfpi.org)

House Democrats Committed to New Hampshire’s Top Needs

By restoring balance in Concord, House Democrats produced a less partisan budget while passing helpful legislation and killing harmful initiatives.

HELPFUL LEGISLATION SUPPORTED BY DEMOCRATS

● Public Education –$170m funding increase statewide

● Health Care – $134m increase for Medicaid Providers

● Affordable Housing – $30m investment in affordable units

● Child Care – $15m funding for workforce enhancement

● Homelessness Support – $10 million in Funding

● PFAS Response Fund – $2 million in funding

● Public Safety – Provides Public Notice of Immigration Checkpoints

Reproductive Rights: Passed bills to remove criminal and civil penalties from New Hampshire’s abortion ban (HB 224- blocked by GOP Senate) and passed the Access to Abortion-Care Act codifying abortion rights in state law (HB 88- blocked by GOP Senate)

Worker’s Rights: Passed bills requiring employers to honor paid time off (HB 74- blocked by GOP Senate) and gave state employees a 10% raise in fiscal year 2024 (HB 2)

Cannabis: Passed legislation to legalize and regulate adult use recreational cannabis (HB 639-blocked by GOP Senate) and established a commission to study a state-run model (HB 611) (While the House did vote to pass this, I did not)

Anti-Discrimination: Passed bills to ban racial profiling in law enforcement (HB 596 - blocked by the GOP Senate) and use of the ‘gay panic defense’ (HB 315)

HARMFUL LEGISLATION BLOCKED BY DEMOCRATS

LQBTQ+ Discrimination: Blocked attempts to target and discriminate against LGBTQ+ youth in schools (HB 10, HB 104, SB 272)

Voting Restrictions: Blocked legislation that would eliminate voter identification affidavits (HB 460)

School Voucher Expansion: Blocked attempts to expand taxpayer funded school vouchers to millionaires (HB 331)

Abortion Restrictions: Blocked a six-week abortion ban (HB 91) and legislation requiring a 24-hour waiting period & misinformation regarding abortion-care (HB 562)

Anti-Immigration: Blocked an attempt to prohibit local control by restricting municipalities from implementing Sanctuary City policies (SB 132)

2023 Year End for NH House

Above, Greenland & Rye State Representatives Peggi Balboni, Dennis Malloy and Jaci Grote wrapping up the legislative session for 2023

The New Hampshire House voted to establish new districts for Strafford County Commissioners.

“HB 75 is a brazen partisan effort to change the make-up of Strafford County Commissioners outside of the established redistricting process,” according to Representative Laurel Stavis (D-Lebanon), Ranking Democrat on the House Municipal and County Government Committee.

Strafford County has elected its County Commissioners county-wide for decades, and after receiving public input during the established redistricting process last year, its county-wide districts were reaffirmed in legislation passed by the House and Senate and signed by Governor Sununu.

Representative Stavis believes “this bill sets a dangerous precedent of annually reopening the once-a-decade redistricting process and will result in instability and chaos. Rigging districts for partisan gain breeds distrust among voters and is not the New Hampshire way” and strongly encourages Governor Sununu to veto this legislation.

Bill to prohibit ‘Gay Panic Defense’ passes House in final vote.

The New Hampshire House adopted the committee of conference report on HB 315, a bill to prohibit the ‘Gay Panic Defense.’ This is the final vote on the bill which will now head to Governor Sununu’s desk.

The ‘Gay Panic Defense’ is a disturbing legal measure that allows a person to, quite literally, get away with murder by claiming provocation by a person’s sexuality or gender expression according to House Democratic Leader, Rep. Matt Wilhelm (D-Manchester).

At a time in our state and nation when LGBTQ+ people are being targeted with violence and hatred for merely existing, making such a legal measure available to homicide defendants is dangerous and wrong for New Hampshire.

Representative Wilhelm said the House took a strong stand against the ‘Gay Panic Defense’ today and urges the Governor to promptly sign HB 315 into law.

The House passed an energy bill containing many changes to state law including net metering.

“Expanding renewable energy and net metering has long been, and will continue to be, a House Democratic priority,” according to Science, Technology, and Energy Ranking Member, Rep. Kat McGhee (D-Hollis). She added that, “HB 281 allows for solar and net metering projects across municipalities, allowing crucial partnerships to lower energy costs. House Democrats unequivocally support expanding net metering, a commitment consistently reflected in our voting record.”

However, Rep. McGee clearly stated that “HB 281 is a tough pill to swallow because it contains many deregulations that will ultimately increase our energy prices and put our environment at risk if not addressed this term. The bill repeals the integrated least-cost resource planning statute, which ensures projects are cost-effective and in the best long-term interests of ratepayers. It also repeals the Energy Efficiency & Sustainable Energy Board. Although breaking these systems without replacing them puts the cart before the horse, House Democrats have received assurances from Republican leadership that we will work together in a bipartisanship manner to address the shortfalls HB 281 has created.”